Estate Tax Repeal - Windfall Oil Company Execs and Cabinet Members

Category: Estate and Inheritance Tax

While obviously partisan, an interesting report from US Representative Henry A. Waxman, Ranking Member, Committee on Government Reform, and the Committee on Government Reform Minority Office. It is a numerical look at who (naming names) might benefit from a total repeal of the estate tax. It caught my eye in that the report is entitled "New Report Reveals Estate Tax Repeal Would Give Over $200 Million Windfall to Oil Company Executives" given that I am spending $3.00 at the pump these days (and thus not feeling particularly inclined to "give" any more to the oil industry).

Tuesday, May 30, 2006 -- Next week the Senate is scheduled to consider legislation (H.R. 8) to repeal the estate tax. Repealing the tax, which has been law since 1916, is estimated to cost $1 trillion from 2011-2021. Although the tax affects few Americans, repeal will give some families extraordinary windfalls. The CEO's of major oil companies, for instance, would get enormous benefits if H.R. 8 were enacted. The family of one oil executive, Lee Raymond (the former ExxonMobil CEO), alone could receive a tax break worth over $160 million.

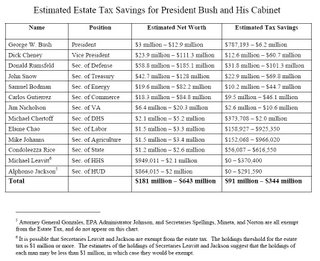

This report analyzes the impact that repeal would have on the families of the senior executives for the major oil companies. In 2005, the minority staff of the Government Reform Committee released a similar analysis showing that repealing the estate tax repeal would save the President, Vice President, and 11 cabinet members as much as $344 million.

1 Comments:

Class envy doesn't seem like the surest ground for criticizing the estate tax. What about the Congressional studies that show the estate tax destroys small businesses, making it impossible to keep them in the family? We can see the obvious effects in the consolidation of the newspaper business and in agribusiness.

I've heard the claims that farms don't have to be sold to pay estate taxes—but I've witnessed the situations when the younger generation encouraged the older farm generation to "take the offer" from the agribusiness. The tax burden and uncertainties that overhang keeping the farm in the family aren't worth the headaches.

Perhaps you think that eliminating the family farm is a good thing, for efficiency and all that. I disagree. But I enjoy your blog.

Post a Comment

<< Home