Elder-Care Costs Deplete Savings of a Generation

Category: Elder Law

From the Wills, Trusts & Estates Prof Blog (authored by my former property law professor, Gerry Beyer) I found this recent NY Times Article Elder-Care Costs Deplete Savings of a Generation (By JANE GROSS, Published: December 30, 2006).

The article introduction tells a sad, but all too common, tale of a child being overwhelmed by the sheer enormity of the task of caring for an aging parent - and the financial, emotional and health costs to the child:

To care for her ailing 97-year-old father over the past three years, Elizabeth Rodriguez, a vice president at the Federal Reserve Bank in New York, has borrowed against her 401(k) retirement plan, sold her house on Staten Island and depleted nearly 20 years of savings.

The money has gone to lawyers fees ($50,000) to win a contested guardianship. It has gone for home-care equipment like the mattress for his hospital bed (about $3,000 in all) and for a food service to deliver meals ($400 a month).

It has gone for a two-bedroom rental apartment big enough for herself, her dad and a home aide ($1,600 a month more than a one-bedroom apartment in the same building), and for a wheelchair-accessible van to get him to doctors appointments ($330 a trip).

Asked to tally the costs, Ms. Rodriguez, 58, said she had no idea how much she was spending. "A shower chair, body cream with no alcohol, new shoes," she said. "You don't stop and calculate. You just buy what you have to buy."

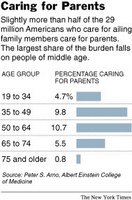

How does this happen? As the article states: "The burden is compounded by ignorance, according to a study by AARP, released in mid-December, which found that most Americans have no idea how much long-term care costs and believe that Medicare pays for it, when it does not." To calbelief befallacy falicy is a gross understatement - as the lack of understanding the costs of long term care prevent the planning for it.

0 Comments:

Post a Comment

<< Home